As the world endures constant changes with varying paces of growth across the globe, the global economy is anticipated to exhibit moderate growth after experiencing a period of economic downturn. The growth pace is projected to persist across most regions in the upcoming years. Lingering uncertainties have prompted the IMF (Refers to World Economic Outlook report published in July 2023) to project the global growth outlook to 3% in 2023 and 2024 (2022: 3.5%). Nevertheless, it remains constrained due to heightened downside risks, particularly tightening of monetary policies to ease inflationary pressures, hence, impeding a robust global economic recovery. Meanwhile, world trade growth is also expected to moderate to 2% in 2023 amid prolonged geopolitical tensions and to record 3.7% in 2024.

Despite escalating uncertainties in the global landscape, Malaysia's economy remains resilient. The GDP is forecast to expand by approximately 4% in 2023 and between 4% and 5% in 2024. The Government acknowledged the World Bank's forecast that Malaysia's growth will be 4.3% in 2024, which is slightly higher than its initial estimate. This is in line with Malaysia’s 2024 growth projection, which will be achieved through robust domestic demand, effectively offsetting the challenges posed by the moderate global growth, supported by the implementation of measures in the new National Energy Transition Roadmap (NETR), New Industrial Master Plan 2030 (NIMP 2030), and the Mid-Term Review of the Twelfth Malaysia Plan (MTR of the Twelfth Plan).

Malaysia's trade grew 6.8% month over month (m-o-m) in October 2023 to reach RM239.52 billion. The value of imports rose by double digits to RM113.33 billion, while exports rose by 1.5% to RM126.19 billion. The 42nd consecutive month of trade surplus since May 2020 was achieved with a trade surplus of RM12.87 billion.

Malaysia's trade fell 2.4% year over year (y-o-y), which was a slower rate than the double-digit drop that was recorded the month before. Imports slightly decreased by 0.2% while exports fell by 4.4%. Malaysia's performance was comparable to that of its principal trading partners, China, Taiwan, Republic of China, and Indonesia, all of which had a decline in worldwide imports and negative trade growth in October 2023.

Trade reached RM2.181 trillion from January to October 2023, surpassing the RM2 trillion threshold. The value of imports was RM995.55 billion, while exports totaled RM1.186 trillion. Exports, imports, and trade all showed an 8% decline from the same time the previous year. The trade surplus decreased to RM190.04 billion, a 7.9% decrease.

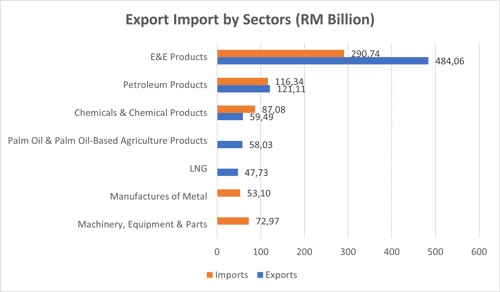

October 2023 saw a 3.5% year-over-year decline in the export of manufactured goods, which made up 85.3% of all exports and RM107.59 billion. This decline was attributed to a decline in the demand for electronics and petroleum products. On the other hand, exports of machinery, components, processed food, transport equipment, metal, paper, pulp, and wood products all showed growth.

Source : Department of Statistics Malaysia, processed by CRIF

Between January and October of 2023, exports of manufactured goods fell 6.3% to RM1.016 trillion from the same period in 2022. This decline was mostly due to lower exports of petroleum products, manufactured goods derived from palm oil, and rubber products. Nonetheless, there was a significant increase in the export of transportation equipment, paper and pulp products, and processed foods.

The value of mining commodities exported fell by 12.8% to RM84.92 billion as a result of decreased shipments of crude oil and LNG brought on by reduced commodity prices. Following a decline in palm oil export prices, fewer shipments of palm oil and agricultural products derived from palm oil saw a 23.0% decline in exports of agricultural commodities to RM77.74 billion.

October 2023 saw a 1.7% year-over-year increase in trade with ASEAN, accounting for 26.9% of Malaysia's total commerce, or RM64.39 billion. Exports decreased by 5.7% to RM36.57 billion as a result of decreased exports of petroleum and E&E products. But rising exports of chemicals and chemical products, together with palm oil and products derived from palm oil-based agriculture, helped to somewhat offset the decrease. ASEAN imports reached RM27.82 billion, a double-digit surge of 13.4%.

Source : Department of Statistics Malaysia, processed by CRIF

ASEAN's top export destinations for Malaysia included Vietnam (RM585.2 million) and the Philippines (RM441.5 million), both of which saw double-digit growth thanks to increasing petroleum product exports. In comparison to September 2023, trade, exports, and imports increased by 5.7%, 2.7%, and 10.0%, respectively.

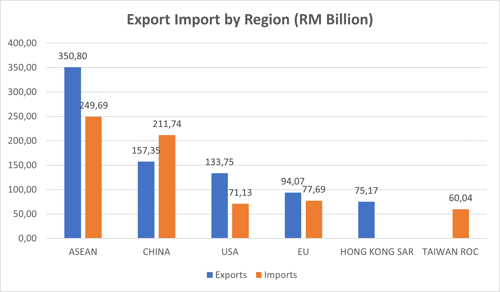

Trade with ASEAN fell 6.9% to RM600.49 billion from January to October 2023 as compared to the same period in 2022. Due to decreased shipments of petroleum products, chemicals, and chemical products as well as palm oil and products derived from palm oil-based agriculture, exports fell by 6.7% to RM350.8 billion. However, there was a rise in the export of processed foods, beverages, tobacco, and non-metallic mineral products. ASEAN imports decreased by 7.1% to RM249.69 billion.

After declining for seven consecutive months, trade with China accounted for 17.7%, or RM42.31 billion, of Malaysia's overall commerce in October 2023. This is a 1.9% year-over-year increase. However, due to a decline in the export of LNG, palm oil and products derived from it, engineering and construction (E&E) items, chemicals, and chemical products, exports to China decreased by 7.0% to RM17.13 billion. Exports of petroleum products, paper and pulp products, metalliferous ores, and metal scrap all saw positive increase despite the contraction. China's imports reached RM25.18 billion, an increase of 8.9%.

Compared to the same time in 2022, trade with China decreased by 8.0% to RM369.09 billion from January to October of 2023. Due to lower shipments of iron and steel products, E&E products, and items derived from palm oil-based agriculture, exports decreased by 9.5% to RM157.35 billion. On the other hand, exports of processed foods, transportation equipment, metalliferous ores, and paper and pulp products increased. China's imports decreased to RM211.74 billion, a 6.9% decrease.

The amount of trade that Malaysia had with the US in October 2023, which made up 9.2% of all trade, decreased by 7.7% year over year to RM22.14 billion. After declining for two months in a row, exports increased by 4.0% to RM14.3 billion.

Increased exports of metal manufacturers, machinery, equipment, and components, as well as transport equipment, all played a role in the expansion. US imports fell to RM7.84 billion, a 23.5% decrease. While commerce and exports decreased by 1.4% and 3.2%, respectively, on a month-over-month basis, imports rose by 2.3%.

In comparison to the same period in 2022, trade with the US decreased by 8.0% to RM204.87 billion in the first 10 months of 2023. Exports decreased by 2.8% to RM133.75 billion as a result of a decline in the export of manufactured goods derived from palm oil, rubber, and wood. On the other hand, exports of optical and scientific equipment, E&E items, and transportation equipment all saw favorable development. The US decreased its imports by 16.5% to RM71.13 billion.

Positive Uptick in Trade with the European Union (EU) Trade with the EU increased 3.4% year over year to RM18.07 billion in October 2023, accounting for 7.5% of Malaysia's overall trade. Due to decreased shipments of petroleum and iron and steel goods, exports fell by 0.1% to RM9.77 billion. However, the double-digit growth in E&E goods and transportation equipment offset the decline in exports. EU imports increased by 7.8% to RM8.3 billion.

Ireland's exports to the EU saw a notable increase of RM251.4 million due to the export of transport equipment, while Italy's exports of manufactured goods based on palm oil climbed by ↑RM246.9 million, and Germany's exports of E&E products increased by ↑RM190 million. Compared to September 2023, trade, exports and imports climbed by 2.9%, 0.6% and 5.7%, respectively.

Comparing the first ten months of 2023 to the same time in 2022, trade with the EU decreased by 3.1% to RM171.77 billion. Exports decreased by 9.1% to RM94.07 billion, driven mostly by lower exports of rubber, palm oil, and items derived from palm oil, while demand increased for E&E products, transportation equipment, and optical and scientific equipment.

Trade with Japan, which accounted for 5.4% of Malaysia's total trade, or RM12.88 billion, decreased by 19.5% year over year in October 2023. RM6.63 billion was the total amount exported, a 23.4% reduction due to reduced shipments of crude petroleum, LNG, and E&E products. On the other hand, processed foods and scientific and optical equipment had double-digit export growth. Japan's imports fell to RM6.25 billion, a 14.9% decline.

Compared to the same time in 2022, trade with Japan decreased by 14.1% to RM129.86 billion in January through October of 2023. Exports decreased 13.3% to RM70.9 billion as a result of decreased exports of E&E, petroleum, and LNG. On the other hand, there was an increase in the export of optical and scientific equipment along with crude petroleum. Japan's imports fell by 15.0% to RM58.96 billion.

Access to the domestic debt markets was maintained for larger corporate entities with sound financial standing. In the first half of 2023, the amount of outstanding corporate bonds increased by 5.2% (December 2022: 4.8%). Corporate bond issuers continued to be of high quality. Due to firm-specific vulnerabilities, just four issuers (2022: 6 issuers) or 0.6% of all outstanding domestic bonds were downgraded over the time. Due mostly to exchange rate values, non-financial corporate external borrowings—which account for 27.2% of total company debt—rose to RM485.3 billion (December 2022: RM461.1 billion).

Most businesses are expected to be able to withstand a potential worsening in the operating environment. Improvements in terms of lower business leverage, healthy cash buffers and more agile business models would also suggest that firms may be better placed to respond to new shocks. Consistent with this, banks do not expect a broad-based tightening in lending standards in the near term. In the unlikely event of a large increase in business defaults, stress tests carried out by the Bank earlier this year affirmed that banks have sufficient capital buffers to absorb significant credit losses arising from the business sector.